Franchising is one of the most appealing ways for people in the UK to enter business ownership. It allows entrepreneurs to operate under an established brand with proven systems, often making the journey less risky than starting from scratch. However, buying a franchise usually involves a significant financial investment, and for many aspiring owners that means securing funding. This raises an important question for those with poor financial histories: can you buy a franchise in the UK with bad credit? While having a low credit score can create hurdles, it does not automatically close the door on your franchising ambitions. The key is to understand how credit impacts the process and what alternative routes are available.

The Impact of Bad Credit on Franchise Funding

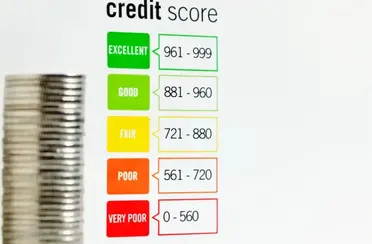

In the UK, lenders view credit scores as a measure of trustworthiness in financial matters. A history of missed payments, defaults, or bankruptcy can make banks cautious about lending, especially when the sums involved are substantial. Since most franchises require an upfront fee, equipment purchases, and working capital, financing is often a necessity. Traditional lenders tend to favour applicants with strong credit histories, so those with bad credit may face rejection or be offered loans at higher interest rates. This can make the path to franchise ownership more complicated but not necessarily impossible.

Franchisor Policies and Financial Criteria

Franchisors themselves also play a role in determining whether bad credit is an obstacle. Some brands require potential franchisees to meet certain financial thresholds, including a minimum credit score, to ensure they can meet ongoing obligations such as royalties, marketing contributions, and staff wages. Others may place more emphasis on the applicant’s business skills, drive, and commitment to the system rather than their past financial record. In certain cases, a franchisor might offer internal financing arrangements or staged payment plans, which could be more accessible to those with weaker credit profiles. Even then, applicants should expect some form of financial vetting, as franchisors will want to protect the brand’s reputation and ensure long-term stability.

Alternative Ways to Finance a Franchise with Bad Credit

While traditional bank loans may be more difficult to obtain with poor credit, there are other ways to secure the necessary funds. Some prospective franchisees rely on personal savings to cover the initial investment, avoiding the need for borrowing entirely. Others seek assistance from family members or close friends willing to provide funding in exchange for a share of the business or repayment over time. Government-backed initiatives such as the Start Up Loan Scheme may consider applicants with less-than-perfect credit if they can present a strong business plan and demonstrate their ability to manage repayments. Specialist finance providers also exist in the UK, catering to borrowers with poor credit histories, although the cost of borrowing is often higher. Additionally, some entrepreneurs choose to partner with an investor who has stronger finances, thereby strengthening their position when approaching both lenders and franchisors.

Strengthening Your Position Despite Bad Credit

Even if your credit history is far from ideal, there are ways to make yourself a more appealing prospect. Demonstrating industry knowledge, business management skills, and a willingness to follow the franchisor’s systems can help reassure decision-makers that you have the qualities needed for success. Preparing a detailed and realistic business plan that addresses potential risks and outlines growth strategies can also help shift attention away from past financial missteps. Furthermore, taking proactive steps to improve your credit before applying — such as paying down debts, making consistent on-time payments, and correcting errors on your credit report — can yield positive results within a matter of months.

Conclusion

Owning a franchise in the UK with bad credit is challenging but far from impossible. While a low credit score may limit traditional financing options and cause some franchisors to hesitate, there are still viable pathways for determined entrepreneurs. By exploring alternative funding methods, seeking flexible franchisors, partnering with financially stable investors, and working to rebuild financial credibility, it is possible to overcome the barriers that bad credit presents. Success will ultimately depend on persistence, resourcefulness, and the ability to demonstrate that, regardless of past setbacks, you are capable of running a profitable and sustainable franchise.